Since the beginning of this year, Our country’s foreign trade imports and exports have maintained growth, Sea freight in Southeast Asia continues to rise, the continued high fever of shipping prices has brought a lot of pressure on foreign trade companies. It has just dropped from a historical high not long ago, but with the recovery of production and consumption in Southeast Asia , And now it’s keeping increasing a lot again. Since entering October, the Southeast Asian shipping market has been rushing, mainly in Vietnam and Thailand, including some ports in Indonesia and Malaysia. The freight rates of these ports have generally risen to more than US$3,000. Why have the ocean freight rates soared? What should foreign trade companies do to face this situation?

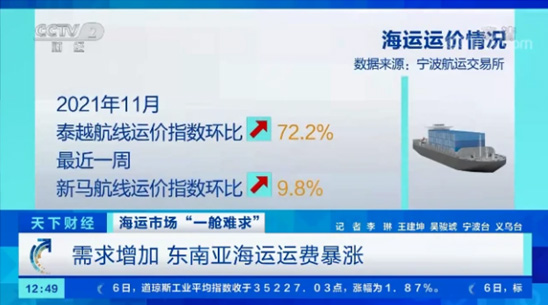

According to data from Ningbo Shipping Exchange, the freight index of Thailand-Vietnam route increased by 72.2% month-on-month in November. In the past week, the freight index of Singapore-Malaysia route increased by 9.8% month-on-month. According to industry insiders, the freight rates of some ports in Vietnam, Thailand, Indonesia, and Malaysia have generally risen by more than US$3,000. Before the epidemic, the freight rate was US$200-300, and during the epidemic, it rose to more than US$1,000. The current price has reached the highest point since the epidemic. It has reached 7-8 times or even 10 times before the epidemic, and many foreign trade companies cannot afford it.

We know that the global economy is intertwined, Move the whole body by pulling a hair, So how will the skyrocketing shipping prices in Southeast Asia have on my country’s foreign trade companies, and what preparations must be made for companies in the import and export industry chain.

Firstly we should know the reasons for sea freight increase:

Shipping is one of the most important modes of transportation in international logistics. Cargo transportation between ports in different countries and regions is carried out by sea. The shipping capacity directly affects the rise and fall of the shipping market. The most fundamental reason why shipping prices cannot fall is due to the booming domestic export trade market. A large amount of cargo is waiting for export, and container space resources are limited, and the limited space resources are mismatched with the massive export cargo, and the shipping lacks the basis for price reduction.

1)From the perspective of shipping capacity.

Southeast Asia, the suspension of railways from Guangxi, Yunnan to Southeast Asia has led to the conversion of digestible space for railways to sea transportation, which has made the seaborne market lacking containers worse. At present, Our country vigorously supports the development of cross-border e-commerce. With the development of cross-border e-commerce, many domestic factories and institutions have flooded into the cross-border e-commerce industry. The volume of foreign trade exports is increasing, and the shipping price will definitely rise.

2) According to a report by the People’s Daily in July this year, Our country’s cross-border e-commerce import and export volume reached 1.69 trillion yuan in 2020, have increased of 31.1%, and the scale of cross-border e-commerce increased nearly 10 times in five years. Recently, we went with the shipping company to check the price of containers in 2022, and the price of the space received has reached the price level of the peak season of 2021 on average. Shipping companies set their prices based on the price level of this year’s peak season, and they certainly have no worries about the container market in 2022.

3) Whether it is by air or by sea, the shipping costs are rising. The ports in the western United States have been busy before, and 24-hour operation could not solve the congestion. There are still many ships waiting to call at the port. Coupled with the arrival of Thanksgiving and Christmas, consumer demand brought by the peak export season has soared, which has promoted the increase in logistics freight rates. In this market context, the high freight rate will continue for some time.

The development prospects of the maritime industry

The 2021 Maritime Transport Review released by the United Nations Conference on Trade and Development (UNCTAD) predicts that from 2022 to 2026, the annual growth rate of maritime trade will slow from 2.9% in the past 20 years to 2.4%. In 2020, maritime trade contracted by 3.8%, reflecting the initial shock caused by the epidemic, but it rebounded at the end of this year. Maritime trade is expected to grow by 4.3% in 2021.

Although the medium-term prospects for maritime trade are still optimistic, it faces increasing risks and uncertainties, including unprecedented pressure on global supply chains, soaring freight rates, the impact of price increases on consumers and importers, and the global trade pattern. Trade tensions and more flexible demand for maritime trade may change.

Rebeca Grynspan, Secretary-General of the United Nations Conference on Trade and Development (Rebeca Grynspan) said that a lasting recovery will depend on the development path of the epidemic, and to a large extent depend on whether the unfavorable factors can be alleviated and whether it can be achieved on a global scale. Promote the new crown vaccine within. The epidemic crisis has the most severe impact on Small Island Developing States (SIDS) and Least Developed Countries (LDC).

In the long run, the epidemic crisis has accelerated the evolution of the general trend of the maritime transport industry and may change maritime transport, such as the promotion of digitalization and automation, which will bring efficiency improvements and cost savings. In addition, the shipping industry is also struggling to adapt to climate change and urgently needs to decarbonize and find alternative fuels to reduce emissions. This will inevitably make the shipping industry pay a price.

At the same time, affected by the epidemic, e-commerce has accelerated the transformation of consumers’ shopping habits and spending patterns, and has promoted the demand for digital distribution facilities and warehousing that provide value-added services. This will bring new business opportunities to shipping and ports.

The “Guiding Opinions on Vigorously Promoting the High-Quality Development of the Maritime Industry” proposes that by 2025, a high-quality development system for the maritime industry will be basically established, service quality, safety, green, and intelligent development will be significantly improved, comprehensive competitiveness, innovation capabilities will be significantly enhanced, and international participation Maritime governance capabilities have been significantly improved. The attention and support of national policies can standardize market competition in the shipping industry, promote the balance of supply and demand in the shipping market, maintain the stable development of the dangerous liquefied water transport market, and promote the healthy, orderly and sustainable development of the industry.

What should foreign traders to do?

1) Must have Plan B

Freight forwarders, shipping companies, ports, air transportation, and charter flights require flexible and diverse transportation combinations. It is not possible to use only one freight forwarder and only one shipping company, which means “don’t hang on a tree.”

The cargo owner mainly maintains the greatest flexibility, keeps in touch with some freight forwarders, and always pays attention to the latest market trends. Always pay attention to some plans to reach the destination faster, such as going to some relatively unpopular ports that do not need to queue up, and arrange trucks directly from the port to the destination warehouse, and try to avoid using the railway plan.

Sea transportation is really too late, so it is immediately adjusted to the air transportation plan. Although the price is expensive, the timeliness of transportation is guaranteed. A small amount of air transportation can alleviate the urgent need and meet the production and order delivery. In short, no matter what scheme was used before, there must be an alternative plan now.

2) Maintain effective communication for everyone

At critical moments, we must ensure normal communication across all channels, and even more active communication. Within the company, the objects of communication include but are not limited to sales, production, marketing, purchasing and other departments.

Let suppliers understand the complexity and difficulty of our work. Let them hurry up production and guarantee delivery.

For external suppliers, ensure transportation capacity and cultivate good partnerships, In this situation, there are multiple friends and multiple paths, and you can’t tell someday you still ask others to help you ship the goods. So the cargo owner put down Party A’s shelf and talked more with Party B about the situation, maybe he can think of you even when he has a cabinet.

3) With the help of digital tool TMS

Traditional mail calls are too inefficient and need to be equipped with TMS tools. Shippers need to balance supply and transportation plans, timeliness and costs, track inventory, and gain greater visibility.

Otherwise, every shipment must be tracked by email and phone, which can really exhaust you. Although the epidemic is not over and the shipping delay has no end, the online digital tools can be put on the agenda. The epidemic is a catalyst for digital transformation.

For orders that have not yet cooperated, how can we quote?

1) Try to quote EXW (delivered from factory) or FOB (delivered on board at the port of shipment) to customers. The buyer (customer) bears the ocean freight for these two trade methods, so we don’t have to worry about this ocean freight issue.

Such a quotation usually appears when the customer has a designated freight forwarder, but in special periods, we can also negotiate with the customer and use EXW or FOB to quote to pass on the freight risk;

2) If the customer requires CFR (cost + freight) or CIF (cost + insurance + freight), how should we quote?

Since it is necessary to add the freight quotation to the quotation, there are several methods we can use:

1) Set a long period of validity, such as one month or three months, and the price can be quoted slightly higher to buffer the price increase period;

2)Set a short validity period, 3, 5, or 7 days can be set, if the time is exceeded, the freight will be recalculated;

3)Quotation plus remarks: This is the current reference quotation, and the specific freight quotation is calculated based on the situation on the day of placing the order or the situation on the day of shipment;

4)Add one more sentence to the quotation or contract: The circumstances outside the agreement shall be negotiated by both parties. (The circumstances outside the agreement shall be negotiated by both parties). This provides room for us to discuss price increases in the future.

www.woodpelletmill.cn

www.woodpelletmill.cn